The Rates, They Are a Rising

Interest rates aren’t a prime example of an exciting topic. After all, most people only care about interest rates when they’re in the market for a new home or looking to refinance an existing loan at a lower rate. Even those capable of drawing a connection between interest rates and retirement portfolios struggle to find clarity with the relationship, finding it mostly affecting bonds, the boring part of the portfolio. I would argue, stay with me here, not only are interest rate movements key drivers of portfolio returns, but we’re living in a fascinating moment in time for interest rates.

I’m sure I just lost most of my audience, but for those of you still reading, thank you. The respect has been noted and will not been forgotten.

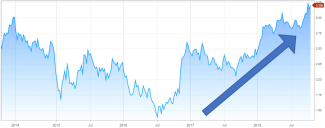

The 2016 election was a shocking event in many ways. From a financial standpoint, none was larger than the leap in rates that occurred, sharply reversing a general trend that had been ongoing since before I was born. Since 1981, when Olivia Newtown John’s Physical was topping the charts, and 10-year U.S. Treasury rates were over 15%, we’ve been in a long term falling interest rate environment. As many of you already know, falling interest rates provide a tailwind to returns when investing in bonds. It was a golden age to be a fixed income investor. Endowments and insurance companies loaded up on fixed income, easily hitting their 6% return targets, all the while enjoying the low volatility bonds provided. Fixed Income money managers like Bill Gross, the “King of Bonds”, built up billion-dollar funds with sterling risk/reward measurements. Like all things that are too good to be true, it wouldn’t last.

Beginning in 2012, 10-year U.S. interest rates began to bottom out, bouncing around rangebound between 1.7% and 2.7%. The long-term inflation rate began acting as a floor for rates, as investors were unwilling to accept locking in returns lower than expected inflation rates. It was at this point we at Sage Advisors began to consider the implications of rising interest rates and adjusting the portfolios accordingly. Thus far, we’ve been discussing bonds as a single monolithic entity, which of course is far from the truth. There are long duration bonds and short duration bonds, government bonds and corporate bonds, investment grade bonds and high yield bonds, fixed rate bonds and floating rate bonds, domestic bonds and international bonds, and on and on and on. Rising interest rates impacts all these bonds in different ways. Long duration U.S. government bonds get hammered with unexpected rate rises, while floating rate bonds thrive in these environments. Higher yielding bonds blunt the impact of rising rates, while lower yielding investment grade bonds cannot. In 2012, we began to shift a portion of our fixed income portfolio to better prepare and protect for the risk posed by a sharp upward movement in interest rates. While we didn’t know at that point what the impetus would be for rates to begin moving back upward, we wanted to be prepared for it. It took almost 4 years before rates really started taking off, but when they did, the portfolios were ready, and we were rewarded with excellent returns amongst many of the new funds.

However, this repositioning of the fixed income portfolios needed to be a balancing act. Bonds are designed to be the conservative ballast of your portfolio, stabilizing returns and lessening volatility, particularly in a stock correction. This creates a potential problem as the bonds that are best able to thrive in a rising interest rate environment are the most equity-like and volatile in a flight to safety scenario like 2008. The solution we designed in your portfolios is a core/satellite approach. The core of the fixed income portfolios is extremely low volatility, investment grade bond funds. These are the funds that excelled in 2008 and have negative correlation to equities. These funds struggle in sharply rising rate environments like the one we are in now, with many down 0.5% to 1% over the past year. They provide the low volatility hedge that conservative portfolios require, and all our core bond funds have outperformed their benchmark index, the Barclays Aggregate Bond Index, since 2016 due to the benefits of active management. This core is then surrounded by what we deem “Satellite Bonds”; bonds that provide lower volatility than stocks but can generate alpha in a rising interest rate environment like the one we find ourselves in today. Floating Rate Funds, High Yield Funds, Foreign Bonds Funds, and Market Neutral Funds are all examples of funds that have historically done well in rising interest rate environments. These funds are up 2% to 5% over the past 12 months, behaving just as we expected them to in a rising rate scenario.

Interest rates, like so many of the other pieces of the financial markets, are notoriously difficult to predict. They may keep shooting up for the next decade. They may level off in the upcoming months and become rangebound at a slightly higher level than before. Maybe they’ll even go back down! The fact of the matter is we can’t predict interest rate movements, but we can prepare for whatever market environment comes next. We can create fixed income portfolios that protect against interest rate risk and principal risk. We can look forward to what the next 30 years hold rather than investing for the last 30 years, and we can feel good about the ongoing quality of our investment portfolios. As always, thank you for the opportunity to serve you, we hope we continue to earn that opportunity for years to come.